To understand why we created StructDB™, prospective customers must first understand the numerous problems in construction funding workflows.

What are these problems?

PROBLEM 1: Numerous Report Formats

- Increases likelihood of overlooking missing data

- Increases likelihood of interpretational error

- Increases time necessary to review reports

- Frustrates standardization of construction-related terminology

PROBLEM 2: Lack of Information Sharing

- No centralized storage for report data and documents -- report documents and data are dispersed among many institution employees, in many locations

- Impedes the ability of upper-level managers to efficiently oversee construction loans

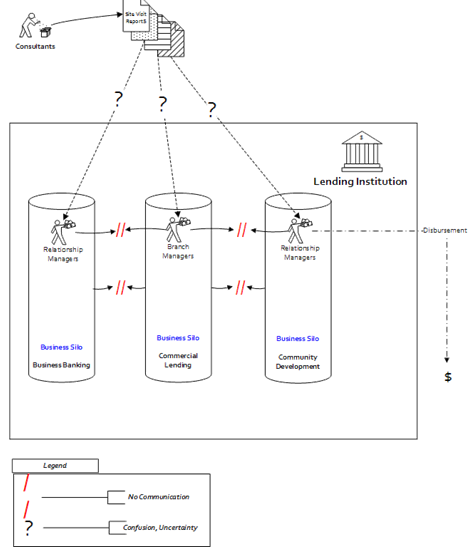

Three diagrams depict how the lack of information sharing plays out in typical construction lending scenarios. The first case shows smaller lending institutions. These rely on the Relationship Manager (or Branch Manager) to review information provided by consultants and make disbursement decisions. The problems with the RM approach are:

- The Relationship Managers typically lack construction lending expertise

- A conflict of interest exists because RM's core focus is to maintain sales with borrower

- Numerous Relationship Managers make it difficult to enforce procedures and share information

- There is no sharing of information and knowledge between Relationship Managers and between Silos

- It is very difficult to audit any set of loans that are dispersed among silos and relationship managers

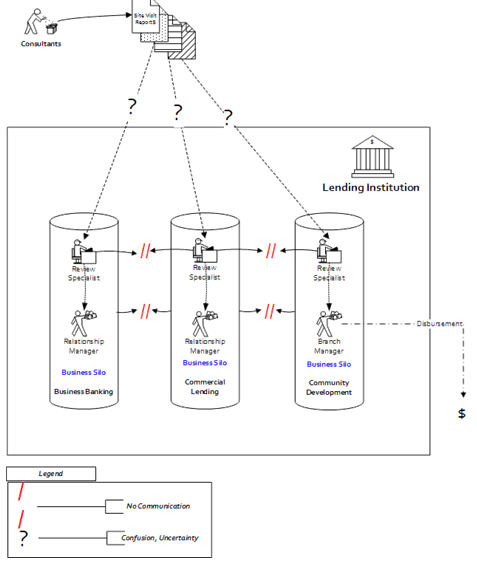

In the second case (Scenario 2), more sophisticated lenders review information provided by consultants by forwarding it to personnel with some construction lending expertise within the same business silo. Here the problems are:

- Review Specialists have some construction lending expertise, but typically not enough

- Review Specialists typically have other duties within the silo that compete for their attention

- Some conflict of interest may exist because Review Specialists have incentive for silo to approve loans

- Little communication exists between Review Specialists and between Silos

- Very difficult to audit any set of loans that are dispersed among silos and Review Specialists

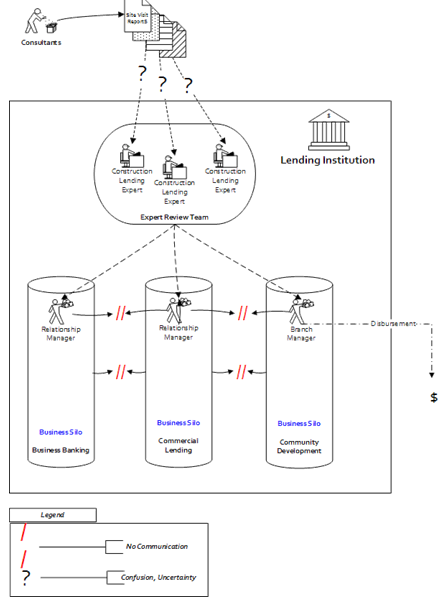

The third scenario shows the most sophisticated lenders. These review information provided by consultants by forwarding it to a core, in-house group of construction lending professionals. This case also has issues:

- Expert Review Team is expensive to maintain per unit of time

- Expert Review Team is often understaffed

- Expert Review Team increases turnaround time for disbursement due to additional layers of procedure and communication

PROBLEM 3: Lack of Quality Control

- Difficult to determine missing information

- Difficult to find and distinguish critical information from less important information

PROBLEM 4: Difficult to Identify Trends

- Reports "gather dust" instead of participating in an active pool of correlated data

- Time consuming for Managers to forecast risk for future projects using hard data

- Risk assessment is often "reactive", normally occurring after a problem has become very serious

- Examples:

How many loans will be complete in 3 months?

How many loans are behind schedule?

What is the total amount of hard cost funds lent to date?

How many disbursements were made in a given region?

The following diagram captures the entire flawed process in existing lending environments:

Now that we have seen the problems in the current lending environment, we'll be better able to understand how StructDB™ solves these problems, bringing faster turnaround and reduced risk to construction lending. These benefits are discussed in the white paper: